Page 56 - SyI-Annual-Report

P. 56

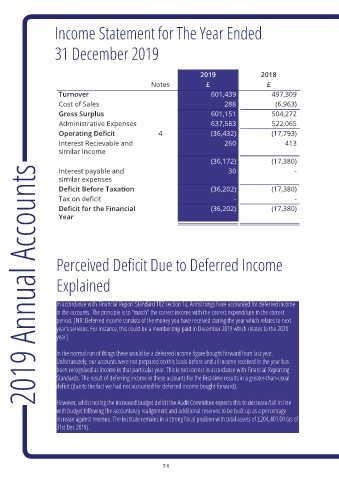

Income Statement for The Year Ended

31 December 2019

2019 2018

Notes £ £

Turnover 601,439 497,309

Cost of Sales 288 (6,963)

Gross Surplus 601,151 504,272

Administrative Expenses 637,583 522,065

Operating Deficit 4 (36,432) (17,793)

Interest Recievable and 260 413

similar Income

(36,172) (17,380)

2019 Annual Accounts

Interest payable and 30 -

similar expenses

Deficit Before Taxation (36,202) (17,380)

Tax on deficit - -

Deficit for the Financial (36,202) (17,380)

Year

Perceived Deficit Due to Deferred Income

Explained

In accordance with Financial Report Standard 102 section 1a, Armstrongs have accounted for deferred income

in the accounts. The principle is to “match” the correct income with the correct expenditure in the correct

period. [NB: Deferred income consists of the money you have received during the year which relates to next

year’s services. For instance, this could be a membership paid in December 2019 which relates to the 2020

year.]

In the normal run of things there would be a deferred income figure bought forward from last year.

Unfortunately, our accounts were not prepared on this basis before and all income received in the year has

been recognised as income in that particular year. This is not correct in accordance with Financial Reporting

Standards. The result of deferring income in these accounts for the first-time results in a greater-than-usual

deficit (due to the fact we had not accounted for deferred income bought forward).

However, whilst noting the increased budget deficit the Audit Committee expects this to decrease/fall in line

with budget following the accountancy realignment and additional reserves to be built up as a percentage

increase against revenue. The Institute remains in a strong fiscal position with total assets of £204,401.00 (as of

31st Dec 2019).

56