Page 59 - SyI-Annual-Report

P. 59

Timing differences arise from the inclusion of income and expenses in tax assessments in periods different from

those in which they are recognised in financial statements. Deferred tax is measured using tax rates and laws

that have been enacted or substantively enacted by the year end and that are expected to apply to the reversal of

the timing difference.

Unrelieved tax losses and other deferred tax assets are recognised only to the extent that it is probable that they will

be recovered against the reversal of deferred tax liabilities or other future taxable profits.

Hire purchase and leasing commitments

Rentals paid under operating leases are charged to surplus or deficit on a straight line basis over the period of the

lease.

Pension costs and other post-retirement benefits

The company operates a defined contribution pension scheme. Contributions payable to the company’s pension

scheme are charged to profit or loss in the period to which they relate.

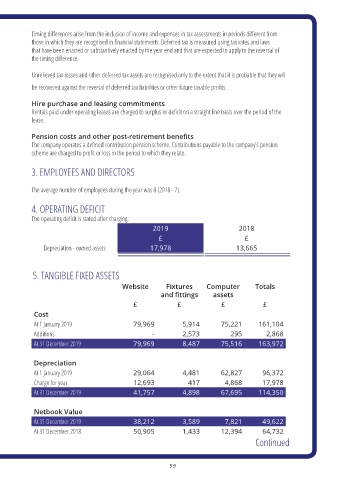

3. EMPLOYEES AND DIRECTORS

The average number of employees during the year was 8 (2018 - 7).

4. OPERATING DEFICIT

The operating deficit is stated after charging:

2019 2018

£ £

Depreciation - owned assets 17,978 13,665

5. TANGIBLE FIXED ASSETS

Website Fixtures Computer Totals

and fittings assets

£ £ £ £

Cost

At 1 January 2019 79,969 5,914 75,221 161,104

Additions - 2,573 295 2,868

At 31 December 2019 79,969 8,487 75,516 163,972

Depreciation

At 1 January 2019 29,064 4,481 62,827 96,372

Charge for year 12,693 417 4,868 17,978

At 31 December 2019 41,757 4,898 67,695 114,350

Netbook Value

At 31 December 2019 38,212 3,589 7,821 49,622

At 31 December 2018 50,905 1,433 12,394 64,732

Continued

59